Introducing factoring

By choosing factoring, our clients can gain immediate access to up to 80-90 percent of the value of invoices issued to their partners, cashing in on capital tied down in outstanding invoices with long payment deadlines. Payment of the remaining amount less factoring costs is made upon the buyer’s fulfillment of their financial obligations.

The advantages of factoring:

- you get immediate access to the majority of your receivables right after invoicing, allowing you to handle 30-180 day payment deadlines without any negative impact on liquidity.

- there is most often no need to provide additional collateral (real estate, material assets, guarantees) - meaning you save on related registration and administrative fees.

- there is no obligation to open a new account, we transfer the factored amount to your existing bank account.

- we employ simplified credit checks complemented by fast and flexible administrative procedures - this way, the application process stays short and simple.

- you can receive first financing in a matter of one or two weeks, which will subsequently remain available as a constant stream.

- through factoring, we provide funds for new orders and the fulfillment of financial obligations related to your operations.

- factoring offers early-stage businesses - without the balance necessary to secure bank financing - access to a constant stream of financing

- financial planning becomes easier and your company’s liquidity more predictable - factored receivables can be taken off the books, improving the business’s creditworthiness and balance structure.

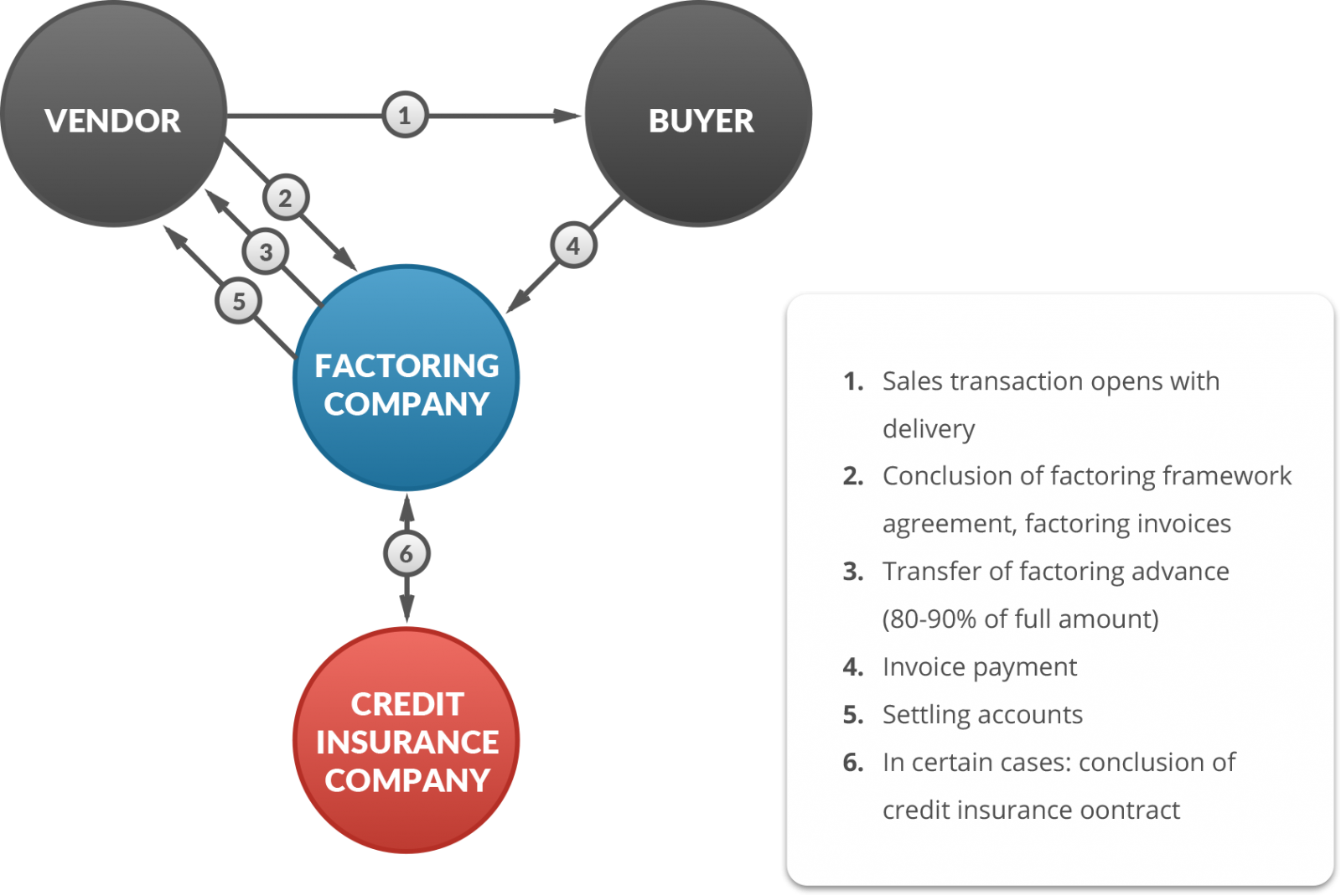

The factoring transaction process:

- The partner submits all documents required for the credit check to City-Faktor.

- Our factoring company completes the credit assessment and makes a business decision based on the result.

- If the evaluation is positive, we sign the factoring framework agreement with the partner.

- Subsequent to our partner’s issuing of an invoice, the respective invoice is assigned and the factoring advance is transferred.

- The buyer on the invoice completes full payment of the outstanding receivable to City-Faktor Zrt.

- Finally, the transaction is completed when we transfer the remaining amount less factoring costs to the partner who issued the original invoice.